Who needs a Statement of net worth?

In matrimonial proceedings concerning alimony, support, and maintenance, both parties must disclose their financial state. The Statement of divorce is used for this purpose. It should be completed by the Plaintiff and the Defendant and filed with the Family Court.

What is the Statement of net worth for?

The Statement of net worth provides information about the individual’s financial state, specifically, the total amount of assets and liabilities. This information is used during the court hearing to determine the individual’s needs and liabilities for the support.

What documents must accompany the Statement of net worth?

The person who fills the form must attach a W-2 form for the previous tax year or income tax return.

When is the Statement of net worth due?

The individual has to complete and file the statement with the court within 20 days after receiving the corresponding notice. The form asks for a lot of information and may take several hours to complete.

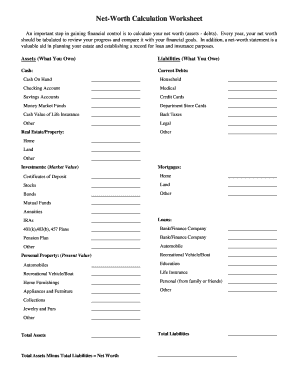

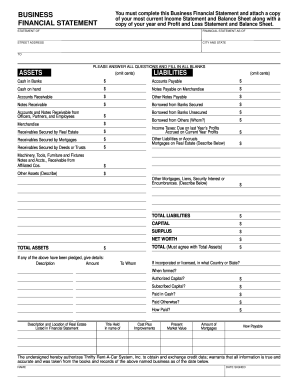

What information should be provided in the Statement of net worth form?

The filler must fill out the following sections:

- Family data

- Expenses (housing, utilities, food, clothing, laundry, insurance, reimbursed medical, household maintenance, household help, automotive, education, recreation, income taxes, miscellaneous)

- Gross income (source of the income and annual amount)

- Assets (cash, checking accounts, savings accounts, security deposits, securities, stocks, options, margin accounts, loans, etc.)

- Liabilities (payable accounts, notes, installment accounts, broker’s margin accounts, mortgages on real estate, interest, taxes, loans on life insurance)

- Transferred assets

- Support requirements

- Counsel free requirements

- Accountant and appraisal fees requirements

Other financial information that should be considered by the Court

The form must be signed by the petitioner and the respondent and certified by the notary public.

What do I do with the form after its completion?

The completed form is filed with the Family Court. One copy is sent to the other part of the case and one copy is kept by the filler.